whilst numerous corporations observed them selves suffering important impacts because of the COVID-19 pandemic, numerous entrepreneurs don't recognize that They could be qualified for significant tax aid, even if they been given funds beneath the Paycheck safety Act (“PPP”). the worker retention tax credit rating (often called the “ERC” or “ERTC”) is actually a refundable tax credit score for organizations that retained their employees over the COVID-19 pandemic. firms are suitable to say the ERC if possibly: the organization was both fully or partly suspended on account of a COVID-19-linked authorities order; or, the business’s gross receipts inside a calendar quarter declined by a lot more than 20% compared to a similar quarter inside the previous calendar year.

The ERC was initially handed as Portion of the Coronavirus help, Relief, and financial safety (“CARES”) Act in 2020, and presents qualified employers having a credit in opposition to selected work taxes.

For 2020, the ERTC was readily available for 50% on the wages paid around $10,000 for every personnel, capped at $5,000 for every personnel. For wages paid out right after January one, 2021, and just before Oct 1, 2022, the ERTC is often placed on 70% of qualifying wages of around $ten,000 per quarter — a greatest of $21,000 per worker as a result of September 30, 2021.

skilled wages include wages and wellness prepare bills compensated to eligible staff between March twelve, 2020, and December 31, 2021. qualified personnel incorporate people who had been retained and paid out through a qualifying period of time, regardless of whether they were actively Doing work or not.

businesses in search of to assert the ERC for 2020 should post documentation by April 15, 2024. Claimants for 2021 have to submit their claims by April 15, 2025.

How Can My business enterprise assert The ERC?

proclaiming the ERC is complicated, and several business owners don’t comprehend They could qualify. Even companies that remained operational in the pandemic can qualify to claim the ERC if government here orders resulted in company interruptions that produced even a partial shutdown of operations.

This system is aimed at compact enterprises that confronted substantial financial adversity in 2020 and 2021 because of the COVID-19 pandemic. The credit might be beneficial to companies who are having difficulties to take care of their workforce, but There are some stipulations. In 2020, a company could acquire around $five,000 for each staff. By 2021, employers will get 70 % of certified wages paid out to personnel, up to $28,000 per employee.

exactly what is the swiftest Way to assert The ERC?

The ERC generally is a important way for organizations to recoup pandemic-period losses in profits, safe money move for fees, and supply Completely ready cash For brand spanking new alternatives. on the other hand, IRS processing of ERC statements can typically acquire as many as 8-twelve months.

nevertheless, for companies searching for to Recuperate their ERC cash on an accelerated timeline, an ERC Bridge bank loan (also referred to as an ERC progress personal loan or ERC mortgage) can make sure total or partial funding of the ERC claim in just a period of months, not months.

dealing with a trusted, knowledgeable service provider will help to ensure that your ERC declare is mistake-cost-free, precise, and processed successfully. At ERTC Funding, our staff of professional analysts do the job to make sure your claim is entire, backed by exhaustive lawful study, and funded on your own timeline – we're your companions at each and every stage of the process. Our partnerships will help you to get as much as ninety% of your claim as swiftly as possible through an ERC Bridge personal loan, allowing for your online business the pliability to fund working day-to-day expenditures and take advantage of alternatives as they crop up.

How Can ERTC Funding enable My company system Its ERC assert Quickly?

ERTC Funding’s workforce of industry experts will evaluate just about every aspect of your declare, and be certain that you'll be obtaining the utmost credit score you might be entitled to. Additionally, ERTC Funding can assist you to finance your claim promptly, letting your little enterprise to receive an ERTC progress or ERTC Bridge bank loan — you’ll obtain up to 90% within your funds in just weeks, not months.

An ERTC Advance (often known as an ERTC Bridge or an ERTC financial loan) is a brief-term loan that is definitely accustomed to make the money out of your pending application for the ERTC accessible to your business straight away. An ERTC progress can make sure that your enterprise has the Prepared money to function and prosper, and eradicates the necessity to hold out for government acceptance of your application.

by strategic partnerships, ERTC Funding can progress you up to ninety% of your anticipated ERC declare in just 2 weeks.

predicted Time: This step usually takes several months, based upon how promptly the required paperwork could be well prepared and accomplished.

will you be Ready To begin with your ERC declare currently?

boasting the ERC might be really complex, and finding your claim Erroneous might have severe penalties. With nuanced regulations to stick to, several checks to apply, and thorough Evaluation required to make an suitable and compliant claim, not just about every ERC organization is equipped to offer the substantial degree of service necessary.

At ERTC Funding (ertcfunding.com), aiding you maximize your lawful ERC claim is our mission. Doing so having a compliance-focused, go away-no-stone-unturned strategy is exactly what tends to make the difference between the typical ERC providers business and one that cares deeply about doing matters the ideal way inside the interest of its purchasers.

Speak to us these days to get rolling!

Amanda Bynes Then & Now!

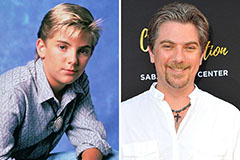

Amanda Bynes Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!